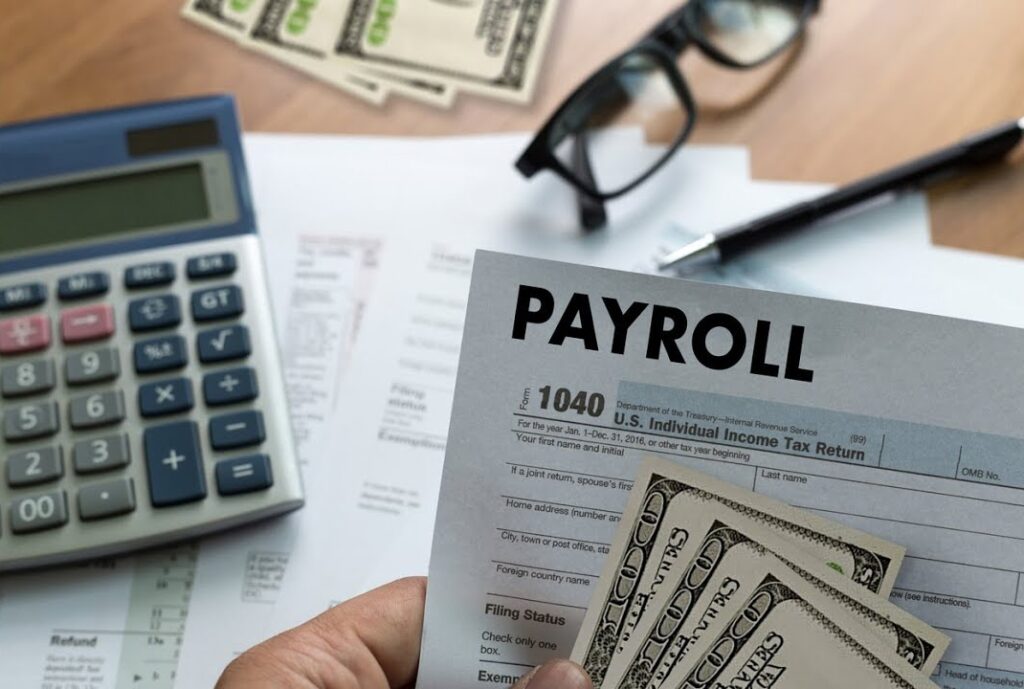

Payroll Services

Navigating the complexities of corporate taxation can be a challenge for any business. At Taxtact Charted Accountants, we specialize in providing comprehensive corporate tax services designed to minimize your tax liabilities and ensure full compliance with the ever-changing tax laws. Additionally, our payroll services are designed to help you efficiently manage employee compensation,

Why Choose Us

We need expert solutions to shape profitable future.

At Taxtact Charted Accountants, we specialize in providing accurate and timely payroll solutions for businesses of all sizes. We ensure compliance with local and national regulations while simplifying the payroll process. Our team manages all aspects of payroll, from calculating wages to handling tax deductions, so you can focus on growing your business. Whether you’re a small startup or an established corporation, our flexible payroll services can be tailored to suit your unique needs, providing peace of mind and saving valuable time.

HOW IT WORKS

Easy Steps & Solutions

Employee Data Collection

We securely collect all necessary employee information, including salary, tax details, and benefits, to ensure accurate payroll processing.

Payroll Calculation

Our experts calculate wages, overtime, deductions, bonuses, and tax contributions based on up-to-date regulations and company policies.

Tax & Compliance Management

We ensure your business is fully compliant with tax laws by calculating and submitting tax deductions, national insurance contributions.

Reporting & Documentation

Taxtact Charted Accountants provides detailed payroll reports, including payslips and tax filings, for full transparency and record-keeping.

What Our Clients Say

Adam Smith

Taxtact Charted Accountants has been a game-changer for my small business. They handle my taxes with precision and always ensure I’m maximizing my deductions. Their team is approachable, and they explain everything in simple terms. I highly recommend their services!

Mandeep Gill

I’ve been using Taxtact Charted Accountants for over two years, and I couldn’t be happier. They’re always up to date with the latest tax laws and provide tailored advice that suits my financial goals. Their attention to detail and proactive approach set them apart from other firms.

Yuraj Bhati

Tax season used to be a nightmare for me, but not anymore! Taxtact Charted Accountants made the entire process smooth and stress-free. They’re incredibly knowledgeable and quick to respond to my queries. I feel confident knowing my finances are in good hands.

Frequently asked questions

Our accounting firm provides a wide range of services, including tax preparation and filing, bookkeeping, financial planning, payroll services, business consulting, and audit support. Whether you’re an individual or a business, we offer tailored solutions to meet your unique financial needs.

You can schedule a consultation by visiting our “Contact Us” page and filling out the online form, or by calling us directly at +44 07547430550. We offer both in-person and virtual consultations to accommodate your preferences.

For your first meeting, please bring any relevant financial documents such as tax returns from the past few years, income statements, bank statements, and any business records (if applicable). This will help us understand your financial situation and provide the best advice.

If you’re struggling with managing finances, keeping up with tax deadlines, or need help with financial planning, an accountant can provide valuable assistance. An accountant can also help you optimize your business’s financial health, ensure compliance with tax laws, and offer strategic advice for growth.

Our accounting services help small businesses by providing accurate financial tracking, helping you manage cash flow, and ensuring you are tax-compliant. We offer strategic advice on budgeting, cost management, and financial planning, which can help you make informed decisions and grow your business sustainably. Our goal is to ensure that your finances are organized and optimized for success.